Personal Insurance Instructions for Participants of

2019 Xilinmen Shaoxing International Marathon

1、Insurance Period

November 10, 2019 Sunday

2、Insurance Coverage

Accidental injuries or sudden acute illnesses happen to the insured in the participation process during the insurance period.

3、Insurance Liability

During the period of this insurance, the insurer shall bear the corresponding insurance liability according to the following provisions for any accidental injuries or acute illnesses happen to the insured in the participation process:

1) Insurance benefit for accidental death caused by injury: If the insured suffers any accidental injury during the insurance period and dies from such injury within 180 days from the occurrence of such accidental injury, the insurer shall pay the insurance benefit for death according to the insurance amount, while insurance liability for this insured shall be terminated.

2) Insurance benefit for death or total disability caused by sudden illness: If the insured suffers a sudden death or death or total disability due to any sudden illness after the waiting period agreed in the insurance contract from the beginning date of the insurance period (or from the beginning date of insured status when the main insurance contract is group insurance; the renewal is not subject to the waiting period), the insurer shall pay the insurance benefit for death according to the insurance amount stipulated in this additional insurance contract.

Sudden illnesses refer to any acute illnesses that the insured suffers suddenly and may endanger life without timely treatment.

3) Insurance benefit for disability caused by accidental injury: During the insurance period, the insured suffers accidental injury and is caused to one of the degrees of disability stipulated in the Life Insurance Disability Assessment Standard and Code (JR/T 0083-2013) (issued by the China Insurance Regulatory Commission (CIRC) (Bao Jian Fa [2014] No. 6) (referred to as Assessment Standard and Code) within 180 days from the occurrence of such accidental injury, the insurer shall pay the insurance benefit for disability by multiplying the corresponding degree of disability stipulated in the Assessment Standard and Code by the insured amount. If the treatment is not completed on the 180th day, the disability assessment shall be carried out according to the physical condition of the day, and the insurance benefit for disability shall be paid accordingly.

a.When the insured is caused two or more disabilities due to the same accidental injury, the insurer shall pay the insurance benefit for disability according to the assessment principles for multiple disabilities as stipulated in the Assessment Standard and Code.

b.If the insured has a disability before such accidental injury, the insurer shall pay the insurance benefit for disability according to the proportion corresponding to the degree of combined disabilities as stipulated in the Assessment Standard and Code deducted by the proportion corresponding to the degree of original disability as stipulated in the Assessment Standard and Code.

4) Medical insurance benefit: If the insured suffers accidental injury during the insurance period and is treated at a secondary or higher level hospital within the territory of the People's Republic of China (excluding Hong Kong, Macao and Taiwan) or a medical institution approved by the insurer, the insurer shall pay the accidental medical insurance benefit according to the following agreeent:

a. For the insured's necessary and reasonable medical expenses incurred in each accidental injury and complying with basic reimbursement scope for medical services issued by the government where the insurance contract is issued, the insurer shall pay the insurance benefit for accidental medical services according to the compensation proportion stipulated in this additional insurance contract and the quotas of out-patient and/or emergency departments on the basis of the balance deducted by the portion compensated or paid from social basic medical insurance or any third party (including any commercial medical insurance) and the deductible amount stipulated in this additional insurance contract. The deductible amount, compensation proportion, and quotas of out-patient and emergency departments shall be agreed between the insured and the insurer and stated in insurance policy.

b. If the insured's treatment is not completed after the insurance period expires, the period of insurance liability that the insurer shall borne may be extended according to the following agreement: Up to 15 days for the insured receiving outpatient treatment, calculated from the next day after expiration of the insurance period; up to 90 days for the insurer who is still in hospital for treatment when the insurance period expires, calculated from the next day after expiration of the insurance period until the date of being discharged from hospital.

c. The liability that the insurer shall bear for insurance benefit for accidental medical services shall be subject to the insured amount under such additional insurance contract. When the insurance benefit paid to the insured once or cumulatively reaches the insured amount under this additional insurance contract, the insurance liability for the insured under such additional insurance contract shall be terminated.

If the insured suffers acute illness suddenly during the insurance period and is treated at a secondary (inclusive) or higher level hospital within the territory of the People's Republic of China or a medical institution approved by the insurer within 24 hours from the occurrence of the illness, the insurer shall pay the insurance benefit for medical expenses incurred in 90 days from occurrence of the illness according to the following agreement.

4、Exemption from liability

1、If the insured dies from the following reasons, the insurer shall not bear the liability for insurance benefits:

(1) Intentional acts of the insured;

(2) The insured injures himself or commits suicide intentionally, except when the insured commits suicide as a person without capacity of civil conduct;

(3) Fighting, attack or murder as a result of provocative or deliberate acts by the insured;

(4) Insured's pregnancy, abortion, childbirth or drug allergy;

(5) Accidents caused by any medical treatments received by the insured, including cosmetology, cosmetic and plastic surgery, etc.;

(6) The insured takes, applies or injects the drug without following doctor's advice;

(7) The insured is affected by alcohol, drugs or controlled drugs;

(8) Diseases, including but not limited to altitude sickness, heat stroke and sudden death (see 6.4 for interpretation);

(9) Bacterial or viral infections that caused by injuries except for accidental ones;

(10) Explosions, burns, pollution or radiation caused by any biological, chemical or atomic energy weapon, or any atomic or nuclear energy plant;

(11) Terrorist attack;

(12) War, military operations, armed rebellion or riots;

(13) Engaged in illegal or criminal activities or detained in accordance with laws, serving a sentence or being a fugitive;

(14) Suffering mental and behavioral disorders (subject to the International Statistical Classification of Diseases and Related Health Issues (ICD-10) issued by World Health Organization);

(15) Drunk driving, driving without a valid driver's license (see 4.3 for explanation), or driving a motor vehicle without a valid driver's license;

(16) Engaged in high-risk sports, except when the insured is engaged in his professional sports as a professional athlete;

(17) Being placed in any aircraft or air transport machine (except when the insured is taking civil or commercial flights as a passenger);

(18) Suffering AIDS or being infected by HIV;

(19) Past medical illnesses and their complications;

(20) Suffering congenital diseases and malformations;

2、If medical expenses are incurred by the insured due to following reasons, the insurer shall not bear liabilities for insurance benefits:

(1) Intentional acts of the insured;

(2) Insured's pregnancy, abortion or childbirth;

(3) The insured has taken, applied or injected drugs without following doctor's advice;

(4) The insured is affected by alcohol, drugs or controlled drugs;

(5) Explosions, burns, pollution or radiation caused by any biological, chemical or atomic energy weapon, or any atomic or nuclear energy plant;

(6) War, military operations, armed rebellion or riots;

(7)The insured intentionally commits a crime or resists criminal enforcement measures taken according to laws;

(8) Suffering AIDS or being infected with the HIV;

(9) Suffering mental and behavioral disorders (subject to the International Statistical Classification of Diseases and Related Health Issues (ICD-10) issued by World Health Organization);

(10) Suffering congenital diseases;

(11) Suffering infectious diseases;

(12) Past medical illnesses and their complications;

Note: Any matters not included in the summary of the above terms shall be subject to the Group Insurance Clauses for Deaths from Accidental Injuries (2009 Edition), Additional Insurance Clauses for Deaths and Total Disabilities Caused by Sudden Diseases, Additional Medical Insurance Clauses for Accidental Injuries (2009 Edition), Additional Insurance Clauses for Disabilities Caused by Accidental Injuries and Additional Medical Insurance Clauses for Acute Diseases issued by PICC.

2、Insured Amount

The insured amount for this life insurance is stipulated as follows: RMB500,000 (RMB50,000 for a minor) for death from accidental injuries, RMB500,000 (RMB50,000 for a minor) for death or total disabilities due to acute illnesses, RMB 500,000 (RMB50,000 for a minor) for disabilities caused by accidental injuries; the medical insurance amount is RMB 100,000 (RMB50,000 for a minor).

Note: A minor is an insured who is under the age of 18 when the policy becomes effective.

6、Application for Insurance Benefits

1、Claim settlement documents:

1) Claim Settlement Application

2) Power of Attorney for Claim Settlement

3) Declaration Form for the Death Beneficiary

4) Original Insurance Policy

2、Required documents for claim settlement:

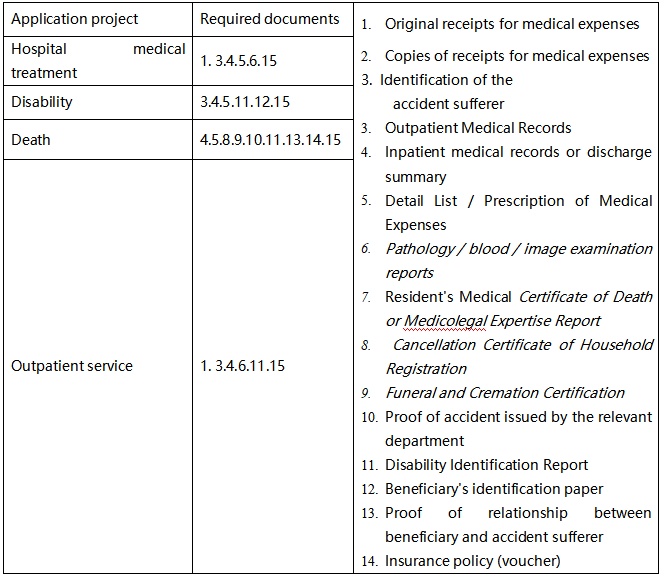

Required materials for application for various insurance

Note: If the above documents are not sufficient to prove related circumstances, the company may require the insured to continue to provide relevant documents for application of claim settlement in order to better protect rights and interests of the insured. If the beneficiary entrusts another person to handle related procedures on his/her behalf, he/she shall provide the Power of Attorney for Claim Settlement signed by him personally, and attach the identity documents of the trustee and the client.

Shaoxing, called "Yue" for short, has been built for more than 2500 years as the archaic city of Yuecountry. Shaoxing Marathon being known as "Yue Ma"

whose definitions is "the most cultural marathon".And setting an "Cultural Yue Ma" brand image will also be the race purpose of Shaoxing Marathon.

Shaoxing Marathon Committee | 浙ICP备05001334号 | 浙公网安备33060202000459号

Shaoxing, called "Yue" for short, has been built for more than 2500 years as the archaic city of Yuecountry. Shaoxing Marathon being known as "Yue Ma"

whose definitions is "the most cultural marathon".And setting an "Cultural Yue Ma" brand image will also be the race purpose of Shaoxing Marathon.

Shaoxing Marathon Committee | 浙ICP备05001334号 | 浙公网安备33060202000459号